How AI Rebalances Your Portfolio Based on Market T

How AI Rebalances Your Portfolio Based on Market Trends

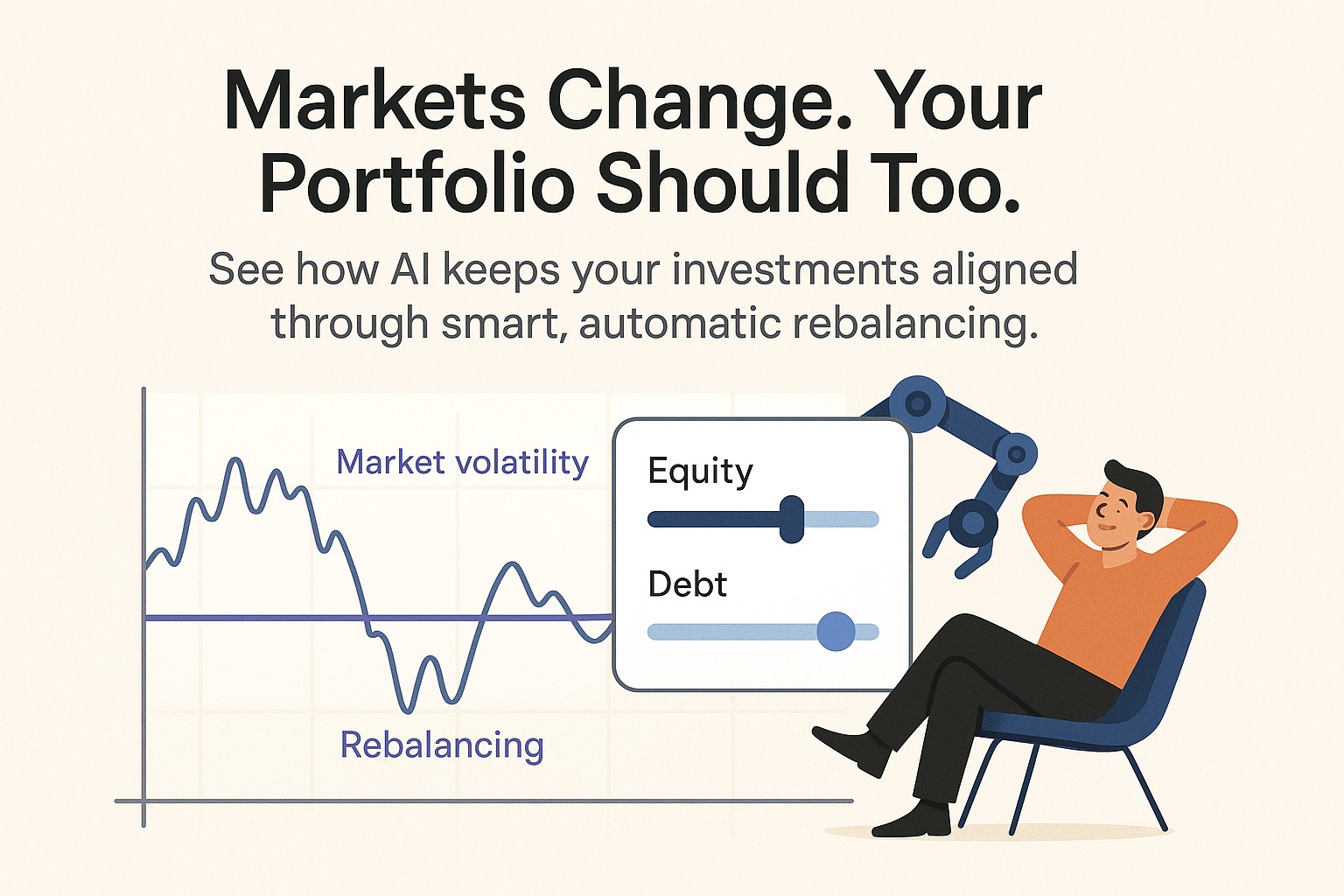

Investing isn’t just about choosing the right mutual funds or stocks—it’s also about keeping your portfolio on track as the market moves.

This is where Portfolio Rebalancing comes in.

And thanks to new technology, especially AI-powered PMS (Portfolio Management Services) like Allrounder by 5nance, Rebalancing has become smarter, faster, and more accurate than ever.

In this blog, we’ll explain how AI rebalances your portfolio based on Market Trends, why it matters, and how it helps reduce risk while staying aligned with your Financial Goals.

What Is Portfolio Rebalancing?Let’s start with the basics.

Portfolio rebalancing means adjusting your investment mix to keep it in line with your original plan.

Imagine you started with a portfolio that’s 70% Equity (Stocks) and 30% Debt (Bonds or fixed-income assets). Over time, if the stock market rises, your equity portion might grow to 80%—making your portfolio more aggressive than intended.

That’s where rebalancing steps in.

The process sells a bit of what’s grown too much (Equity in this case) and adds more to what’s underweight (like Debt), bringing the mix back to your target.

Why Rebalancing MattersWithout rebalancing, your portfolio may:

Take on more risk than you’re comfortable with

Miss out on gains by being overexposed to underperforming assets

Move away from your financial goals (like retirement or buying a home)

In India, markets can be volatile and sector performance changes rapidly. Sometimes equity rallies; other times gold or debt outperforms. If you don’t rebalance, your investments might get lopsided—putting your future plans at risk.

👉 Rebalancing is like steering a vehicle.

Even on a straight road, you need to keep adjusting the wheel. Otherwise, you’ll drift off course.

This is where AI-powered PMS changes the game.

Instead of manually reviewing your portfolio every few months—or relying on gut feeling—AI uses real-time data, pattern recognition, and goal tracking to decide when and How to Rebalance.

Here’s what it does behind the scenes:

- Constant MonitoringAI scans:

Market trends

Asset performance

Sector movements

Interest rates

Economic indicators

All of this is compared to your personal plan: your goals, time horizon, and risk appetite.

- Rule-Based RebalancingOnce the asset mix deviates beyond a certain limit—say, your equity goes from 70% to 80%—AI automatically triggers rebalancing.

This is done without delay, and without human emotion getting in the way.

- Personalized RebalancingNot everyone’s portfolio is the same.

If you’re saving for a child’s education in 3 years, your rebalancing will look different from someone saving for retirement in 25 years. AI understands these differences and adjusts accordingly.

Real-Life Example: When AI Triggers a RebalanceLet’s say Rohan is investing ₹10,000/month in Allrounder.

In 2024, the Equity Markets rally and his 60% Equity/ 40% Debt Allocation became 75/25.

Here’s what happens next:

The AI system detects that his portfolio has drifted beyond the safe range.

It sells a portion of high-performing Equity and shifts that to Debt.

This locks in profits, Reduces Risk, and brings the portfolio back to 60/40.

All of this happens without Rohan having to analyze markets everyday thanks to AI powered PMS All Rounder.

Instead of waiting for quarterly reviews or market crashes, AI makes small, smart adjustments that keep things smooth and stable.

How AI Reduces Risk Through RebalancingRisk is part of investing—but unmanaged Risk is dangerous.

Traditional PMS often carry more risk than investors realize, especially if rebalancing is ignored.

AI solves this by:

📉 Bonus: Rebalancing Can Improve Returns Too

Several studies (including those by Morningstar and Vanguard) show that rebalanced portfolios often outperform those that are left alone—not because of higher returns, but because of better risk-adjusted returns.

In other words, you earn more with less stress.

Manual vs AI-Driven Rebalancing: Why Automation WinsLet’s compare the two:

Feature

Manual Rebalancing

AI-Based Rebalancing

Frequency

Once in 6–12 months

Real-time or monthly

Based on

Gut feeling or reviews

Market data + your goals

Timing

May be delayed

Instant, automated

Personalization

Generic

Fully customized

Cost of delay

High

Very low

Clearly, AI wins on speed, accuracy, and personalization.

Allrounder by 5nance: AI That Works for YouIf you're looking for an AI-powered PMS that takes care of rebalancing and more—Allrounder by 5nance is built just for that.

👉 Multi-Asset Portfolio (Equity, Debt, Gold, and more)

👉 Smart Rebalancing driven by your Goals

👉 No emotional investing, no delays

👉 Transparent, Automated, and beginner-friendly

👉 Start with just ₹10,000/month

Whether the market is up or down, Allrounder ensures your portfolio is always aligned—so you’re not just investing, you’re investing right.

Final Thoughts: Don’t Just Invest. Stay Aligned.Investing is not a one-time action. It’s an ongoing journey.

And on that journey, markets will change. Sectors will rise and fall. Goals may evolve. Without regular rebalancing, your portfolio might silently drift off course—risking your future.

That’s why using AI-powered Portfolio Management isn’t just smarter—it’s safer.

Platforms like 5nance.com do more than just Invest your money. They monitor, adjust, protect, and optimize—so you can focus on your goals, not the markets.