欧博官网How to Learn Trading the Right Way While Worki

In 2025, India's financial landscape is undergoing rapid evolution. The rise of digital investing platforms, UPI payment systems, and access to global markets has made trading more accessible than ever.

Whether it's stock trading, options, cryptocurrencies, or Forex, many working professionals are turning to the markets to build wealth outside their 9-to-5 jobs.

In this comprehensive guide, we'll walk through the exact steps you can follow to become a skilled trader while keeping your full-time job, along with inspiring stories from Indian traders who've done it successfully.

Yes. And many have done it. In fact, many of India's top part-time traders began while working demanding jobs in IT, banking, engineering, or education. The key isn't working longer hours but using smarter, focused time.

You don't need to stare at charts all day or quit your job. With as little as 1 to 2 hours a day, you can build solid trading skills if you follow a structured path.

Learning to trade the right way means:

Developing a structured study plan

Practising with patience

Using data and discipline, not emotion

Managing risk and expectations

Let's explore how.

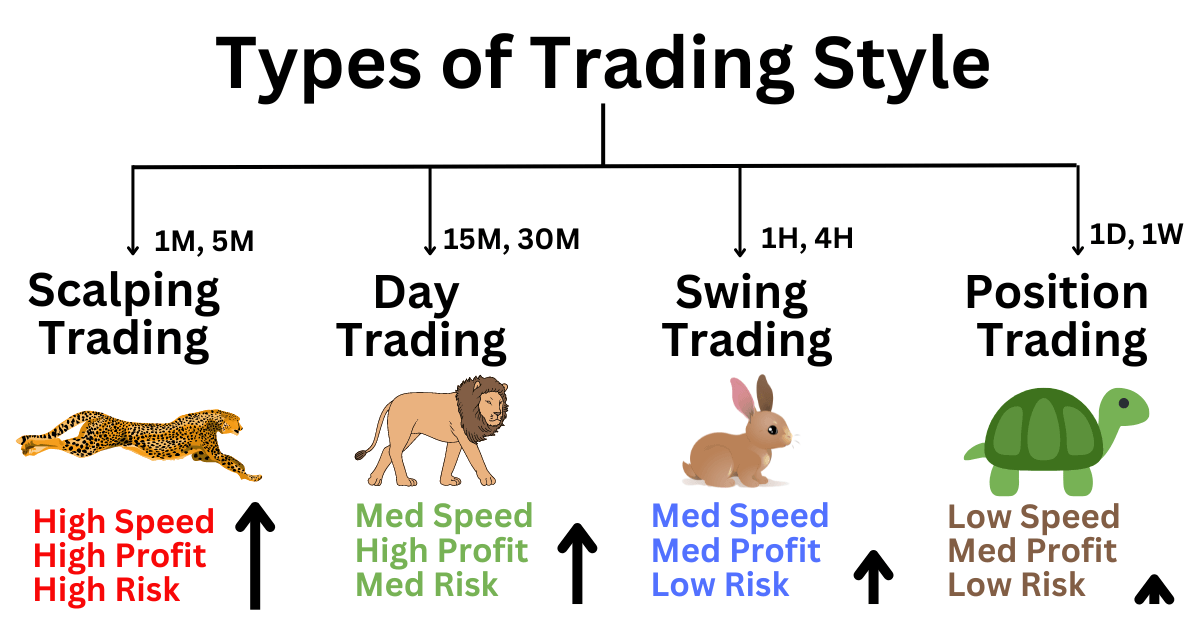

Step 1: Understand What Type of Trading Suits You

Not all trading is the same, and not all of it fits a working schedule. As a full-time employee in India, your time is limited. Thus, you must select a trading style that complements your job rather than conflicts with it.

The best trading styles for full-time workers:

Swing Trading: Holding trades for a few days to a few weeks. Suitable for those who can check the markets after work or during lunch hours.

Position Trading: Longer-term trades based on broader trends, great for professionals who only have time on weekends.

Copy or Social Trading: Passive trading by following experienced traders, ideal for beginners with less time but a desire to learn.

Intraday Trading (Cautiously): Possible for those with flexible work hours or remote setups, but requires more monitoring.

For most Indian professionals, swing trading offers the best balance between control, flexibility, and learning.

Step 2: Set a Dedicated Learning Schedule (Even 1 Hour Works)

Learning to trade is like learning a new language or musical instrument. You need consistency more than intensity.

Begin with a practical study schedule that aligns with your working hours. For example:

Weekdays: 30–60 minutes of reading, watching tutorials, or analysing charts after work

Weekends: 2–3 hours of deep learning, backtesting, or paper trading

Use tools like Google Calendar or Notion to block learning time just like meetings. Treat it seriously, as this is your second career in the making. Even 7 hours a week or one per day is enough to build skills in 3–6 months.

Step 3: Choose Your Market — Stocks, Forex, or Crypto?

In India, most beginners begin with stock market trading. But others explore global Forex markets, commodities, or cryptocurrencies.

Here's a quick overview:

Stock Trading (NSE/BSE): Regulated, well-known, and recommended for beginners

Options Trading: Advanced strategy with leverage; requires more study

Forex Trading: Offers 24/5 access; great for those with evening availability

Crypto Trading: Open 24/7; volatile and needs strict risk control

For working professionals, stock swing trading or Forex in the evening hours can fit well with your schedule. You can explore and decide based on what resonates with you after basic research.

Step 4: Learn the Right Way (Not from Instagram Reels)

There's a lot of misinformation about trading online, especially on social media. While platforms like Instagram or Telegram can introduce you to trading, they're not the right place to build deep skills.

Instead, rely on structured, credible sources. Where to learn:

Pick one or two trusted sources and build a solid foundation. Avoid jumping from one "guru" to another every week.

Step 5: Use a Demo Account First

Before putting in real money, open a demo account with a broker. It allows you to trade with virtual money in live market conditions.

Benefits of demo trading:

You understand how platforms like MT4/MT5 work

You test your strategies without risking real money

You build discipline and confidence

Spend at least 1–2 months practising on a demo before going live. Numerous successful traders claim this helped them avoid expensive errors during the initial phases.

Step 6: Start Small with Real Money and Track Everything

When you're ready, begin live trading with a modest amount—₹1,000 to ₹5,000 is acceptable. It isn't to make big profits, but to learn how real money feels in a trade.

Keep a trading journal. Record:

Why did you enter the trade

Entry and exit price

What worked and what didn't

Emotions you felt

This process trains you to think like a professional and gradually improves your system.

Step 7: Learn Risk Management from Day One

One of the biggest reasons traders fail is poor risk management. For example, they invest excessive amounts, trade excessively, or attempt to recoup losses.

Simple risk rules:

Never risk more than 1–2% of your capital on a single trade

Use stop-loss in every trade

Don't trade with money meant for rent or bills

Accept that losses are part of the process

Managing risk is the most important habit you can build, and it's what will protect your trading career in the long run.

Step 8: Stay Emotionally Disciplined — Especially After Work

After a long, stressful workday, you may feel tempted to engage in emotional trading. You might chase profits, overtrade, or get impatient.

Successful traders separate work stress from trading discipline.

Some tips:

Take a 10-minute break before analysing the markets

Trade only when calm and focused

Avoid trading if you're feeling anxious or frustrated

Limit the number of trades per day or week

Treat trading as a mental game. The more you stay composed, the better your results will be.

Saurabh Sinha – IT Engineer

Saurabh worked 10 hours a day in tech support. He began trading stocks in 2022 with ₹2,000 and gained knowledge.

By 2024, he was engaging in swing trading with the Nifty50 on a part-time basis and now earns an average of ₹10,000–₹15,000 monthly as additional income.

"I didn't need to quit my job—I just needed to stick to a routine and stop chasing every trade," he says.

Meera Kapoor – Teacher

Meera started copy trading while employed full-time as a school educator. She used weekends to learn technical analysis and now trades Nifty options with a steady win rate.

"I trade less, but with more logic. It's become a second income and a confidence boost," Meera says.

Rakesh Iyer – Mechanical Engineer

Rakesh initially lost ₹20,000 following WhatsApp groups. After pausing and learning proper risk management, he started small again. He now follows the US Forex markets in the evening and uses a simple support/resistance strategy.

"The turning point was treating trading like a skill, not a shortcut to get rich," he shares.

It depends on your pace, market, and commitment. But here's a general roadmap:

1–2 months: Understand basics, open a demo account

3–6 months: Practice strategies, start a real account

6–12 months: Build consistency and a trading journal

1–2 years: Aim for consistent profits and explore scaling up

Remember, it's not a race. Even if you spend just 1 hour per day, you'll be ahead of 90% of people who never start.

1. Can I Learn Trading While Working a Full-Time Job in India?

Yes, many professionals in India successfully learn trading while working full-time. With as little as 1–2 hours a day, you can build trading skills through structured learning, demo practice, and weekend study sessions.

2. What Is the Best Type of Trading for Someone Working Full Time?

For full-time employees, swing trading and position trading are the most suitable. These styles don't require constant monitoring and can be managed in the evenings or during weekends.

3. Is It Risky to Trade While Working a Full-Time Job?

Trading involves risk, but you can manage it effectively by starting small, using stop-loss orders, and trading only with money you can afford to lose. Avoid overtrading or emotional decisions, especially after stressful workdays.

In conclusion, learning to trade while working full-time in India is not only possible, it's practical. However, it requires the same approach as learning any other profession, such as structured learning, practice, risk management and emotional discipline.

With time, even your small wins will begin to compound financially and mentally. Remember, you don't need to quit your job to start trading. But one day, your trading skills could give you the option to.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.