22 Best Startup Accelerators Worldwide in 2025

The global startup ecosystem has evolved dramatically, with accelerators playing a pivotal role in scaling innovative companies. According to Startup Genome's Global Startup Ecosystem Report, the global startup economy is now worth over $4.8 trillion, with accelerators becoming increasingly crucial for early-stage success.

Top accelerators have been instrumental in this growth, with Y Combinator alone producing companies worth over $600B. This comprehensive guide explores the world's top accelerator programs and how to maximize your chances of acceptance. We'll examine investment terms, program structures, and success metrics to help you choose the right program for your startup.

Quick Overview of Top Global Startup AcceleratorsAcceleratorLocationInvestmentsNotable ExitsInvestment SizeProgram LengthSuccess Rate

Y Combinator Global/Remote 3000+ 200+ $500K 3 months 90%

Techstars Global 2500+ 150+ $120K 3 months 85%

500 Global Global 2500+ 100+ $150K 4 months 80%

Plug and Play Global 2000+ 80+ Varies 3 months 82%

Startup Chile Santiago 1800+ 50+ $30K 6 months 75%

SOSV Global 1000+ 70+ $150K 4 months 85%

Antler Global 500+ 30+ $110K 6 months 80%

Founders Factory London/NYC 200+ 40+ £30K 6 months 85%

Station F Paris 1000+ 45+ Varies 12 months 78%

Startupbootcamp Global 1000+ 60+ €15K 3 months 82%

APX Berlin 100+ 20+ €50K Ongoing 80%

Creative Destruction Lab Global 300+ 25+ $125K 5 months 85%

Alchemist Silicon Valley 500+ 40+ $36K 6 months 82%

HAX Global 250+ 30+ $180K 6 months 80%

Entrepreneur First Global 300+ 25+ £80K 6 months 85%

Barclays Accelerator Global 150+ 30+ Varies 13 weeks 75%

AWS Startup Accelerator Global 200+ 40+ $25K 10 weeks 80%

Apple Entrepreneur Camp Global 100+ 20+ Varies 1 year 90%

AICPA Startup Accelerator US 50+ 10+ $25K 6 months 75%

Boeing HorizonX Global 100+ 25+ Varies 6 months 80%

Google for Startups Global 1000+ 200+ $100K 3 months 85%

Intel Ignite Global 150+ 30+ Varies 12 weeks 80%

With acceptance rates below 3%, successful applications require more than just a great idea. Here's how top founders optimize their applications using data and analytics:

1. Pre-Application IntelligenceTrack engagement with accelerator partners before applying:

2. Tailored Applications by ProgramCreate program-specific versions of your deck:

Y Combinator: Focus on growth metrics and market size

Techstars: Emphasize corporate partnership potential

500 Global: Highlight international expansion plans

Pro tip: Use Papermark's data room to organize different deck versions and supporting documents.

Convert initial interest into interviews:

Get notified when partners re-review your deck

See which financial projections they spend time on

Follow up with relevant updates based on their focus

Track email opens to time your follow-ups perfectly

4. Application SecurityProtect your intellectual property during the process:

Set expiration dates on sensitive documents

Use dynamic watermarking for confidential info

Control screenshot permissions by recipient

Track document forwarding within accelerator teams

How to Share Your Pitch Deck with Investors During Accelerator ProgramsThere is no guarantee that investors will say yes, and the chances are low - on average, only 1/100 pitches result in investment. The best you can do is capture interest as soon as possible or get a no and move on.

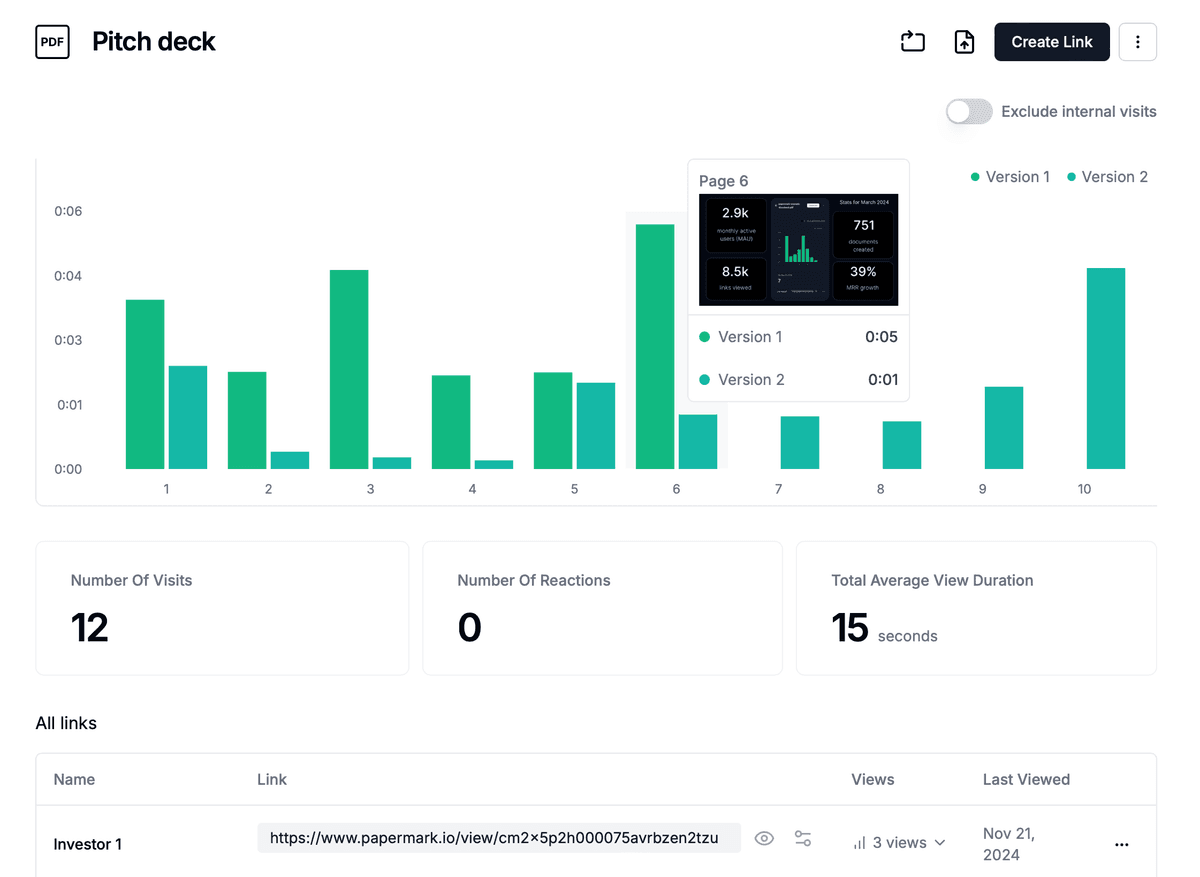

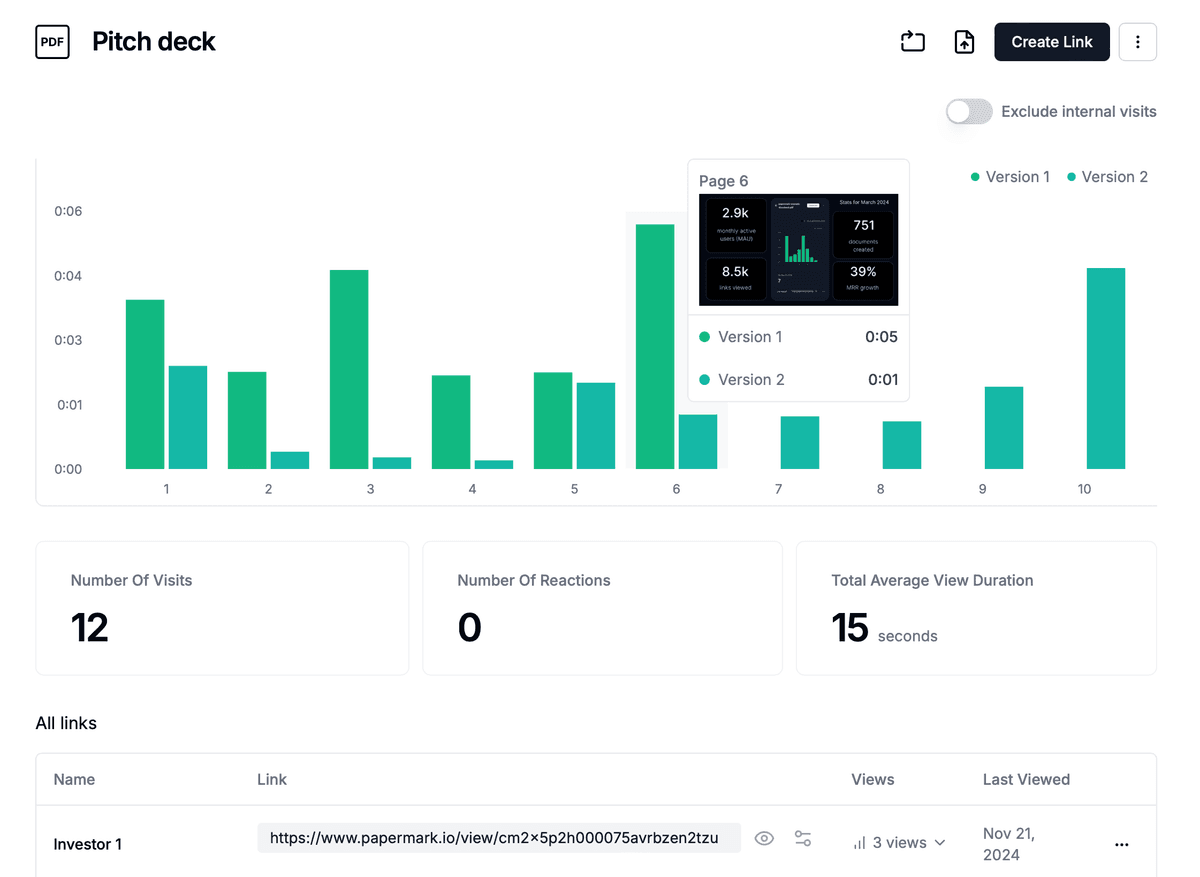

How? Share your pitch deck as a link not as an attachment and get insights if investors are interested:

Get notified when investors view your deck

Track how long they were on each page of your deck

Capture emails of investors who viewed your deck

Protect your IP using watermark, screenshot protection and other link permissions

Securely send data room with multiple documents

Share deck via trackable link

1. Y CombinatorThe world's most prestigious startup accelerator, known for producing unicorns like Airbnb and Stripe.

Website: ycombinator.com

CategoryDetails

Investment Terms $500K ($125K for 7% + $375K on uncapped MFN SAFE)

Program Length 3 months

Notable Alumni Airbnb, Stripe, Dropbox, Coinbase

Focus Areas All sectors

Success Metrics • Portfolio value: $600B+

• Companies funded: 3000+

• Unicorns: 100+

Global network of accelerators with strong corporate partnerships and regional focus.

Website: techstars.com

CategoryDetails

Investment Terms $120K ($20K for 6% + $100K convertible note)

Program Length 3 months

Notable Alumni SendGrid, DigitalOcean, ClassPass

Focus Areas Tech, AI/ML, Regional Programs

Success Metrics • Portfolio value: $75B+

• Global locations: 15+

• Companies funded: 2500+

Early-stage venture fund and accelerator program with strong international presence.

Website: 500.co

CategoryDetails

Investment Terms $150K for 6% equity

Program Length 4 months

Notable Alumni Grab, Canva, Talkdesk

Focus Areas Global Markets, Technology

Success Metrics • Portfolio value: $100B+<br/>• Countries: 80+<br/>• Active investments: 2500+

Website [500.co](https://500.co)

World's largest innovation platform connecting startups with corporations.

Website: plugandplaytechcenter.com

CategoryDetails

Investment Terms No equity required (corporate sponsorship model)

Program Length 3 months

Notable Alumni PayPal, Dropbox, N26

Focus Areas Industry-specific (16 verticals)

Success Metrics • Corporate partners: 500+<br/>• Annual investments: 250+<br/>• Global locations: 40+

Website [plugandplaytechcenter.com](https://www.plugandplaytechcenter.com)

Latin America's premier government-backed accelerator program.

Website: startupchile.org

CategoryDetails

Investment Terms $30K equity-free grant

Program Length 6 months

Notable Alumni Cornershop, Prey, SaferTaxi

Focus Areas All sectors, Latin American market

Success Metrics • Companies accelerated: 1800+<br/>• Job creation: 5000+<br/>• Economic impact: $1.4B+

Website [startupchile.org](https://www.startupchile.org)

Deep tech accelerator network focusing on hardware, biotech, and enterprise.

Website: sosv.com

CategoryDetails

Investment Terms $150K initial investment

Program Length 4 months

Notable Alumni BitMEX, Perfect Day, NotCo

Focus Areas HAX (Hardware), IndieBio (Biotech), Orbit (Enterprise)

Success Metrics • Portfolio value: $12B+<br/>• Companies funded: 1000+<br/>• Follow-on funding rate: 70%+

Website [sosv.com](https://www.sosv.com)

Global early-stage VC firm and accelerator focusing on founder matching and team building.

Website: antler.co

CategoryDetails

Investment Terms $110K for 10% equity

Program Length 6 months

Notable Alumni Xanpool, Sampingan, Volopay

Focus Areas Technology, Team Building

Success Metrics • Global presence: 25+ cities<br/>• Founder network: 5000+<br/>• Portfolio companies: 500+

Website [antler.co](https://www.antler.co)

Corporate-backed accelerator with strong industry partnerships.

Website: foundersfactory.com

CategoryDetails

Investment Terms £30K + operational support

Program Length 6 months

Notable Alumni Acre, Karakuri, Qure.ai

Focus Areas Industry-specific programs

Success Metrics • Corporate partners: 35+<br/>• Companies built: 200+<br/>• Success rate: 85%

Website [foundersfactory.com](https://www.foundersfactory.com)

World's largest startup campus and accelerator program based in Paris.

Website: stationf.co

CategoryDetails

Investment Terms Varies by program

Program Length 12 months

Notable Alumni Zenly, Alan, Payfit

Focus Areas Tech, AI, Blockchain

Success Metrics • Startup residents: 1000+<br/>• Partner programs: 30+<br/>• Workspace: 34,000 sq meters

Website [stationf.co](https://stationf.co)

Europe's largest network of industry-focused startup accelerators.

Website: startupbootcamp.org

CategoryDetails

Investment Terms €15K for 8% equity

Program Length 3 months

Notable Alumni Tespack, Insly, Zenaton

Focus Areas FinTech, IoT, Smart Cities

Success Metrics • Programs worldwide: 20+<br/>• Corporate partners: 150+<br/>• Startups accelerated: 1000+

Website [startupbootcamp.org](https://www.startupbootcamp.org)

Axel Springer and Porsche's joint early-stage accelerator.

Website: apx.ac

CategoryDetails

Investment Terms €50K for 5% equity

Program Length Ongoing support

Notable Alumni Zage, Bunch, Homeday

Focus Areas Digital Media, Mobility, Future of Work

Success Metrics • Portfolio companies: 100+<br/>• Follow-on funding rate: 75%<br/>• Corporate network: 100+

Website [apx.ac](https://www.apx.ac)

Academic-affiliated accelerator focusing on science-based ventures.

Website: creativedestructionlab.com

CategoryDetails

Investment Terms $125K optional investment

Program Length 5 months

Notable Alumni Deep Genomics, Xanadu, Ada

Focus Areas AI, Quantum Computing, Biotech

Success Metrics • Equity value created: $15B+<br/>• Global locations: 10<br/>• Mentor network: 2000+

Website [creativedestructionlab.com](https://www.creativedestructionlab.com)

Enterprise-focused accelerator backed by top Silicon Valley investors.

Website: alchemistaccelerator.com

CategoryDetails

Investment Terms $36K for 5% equity

Program Length 6 months

Notable Alumni LaunchDarkly, Rigetti Computing, Privacera

Focus Areas Enterprise SaaS, B2B

Success Metrics • Average seed round: $2M+<br/>• Companies funded: 500+<br/>• Enterprise partnerships: 150+

Website [alchemistaccelerator.com](https://www.alchemistaccelerator.com)

World's first and largest hardware accelerator.

Website: hax.co

CategoryDetails

Investment Terms $180K for 9% equity

Program Length 6 months

Notable Alumni Particle, Makeblock, Amber Agriculture

Focus Areas Hardware, IoT, Robotics

Success Metrics • Products launched: 250+<br/>• Patents filed: 1000+<br/>• Manufacturing partnerships: 100+

Website [hax.co](https://www.hax.co)

Talent-first investor building teams from scratch.

Website: joinef.com

CategoryDetails

Investment Terms £80K investment opportunity

Program Length 6 months

Notable Alumni Magic Pony, Tractable, CloudNC

Focus Areas Deep Tech, AI, Enterprise

Success Metrics • Portfolio value: $10B+<br/>• Global locations: 6<br/>• Companies built: 300+

Website [joinef.com](https://www.joinef.com)

Barclays Accelerator, powered by Techstars, focuses on fintech innovation and financial services transformation.

Website: barclaysaccelerator.com

CategoryDetails

Investment Terms Varies by program

Program Length 13 weeks

Notable Alumni Bud, CreditLadder, Moneybox

Focus Areas FinTech, Financial Services

Success Metrics • Companies accelerated: 150+<br/>• Global locations: 3<br/>• Corporate partnerships: 50+

Website [barclaysaccelerator.com](https://www.barclaysaccelerator.com)

Amazon Web Services' accelerator program helps startups build and scale their cloud-based solutions.

Website: aws.amazon.com/startups

CategoryDetails

Investment Terms $25K AWS credits

Program Length 10 weeks

Notable Alumni Figma, Notion, Canva

Focus Areas Cloud Computing, SaaS, AI/ML

Success Metrics • Companies accelerated: 200+<br/>• AWS credits: $1M+<br/>• Technical mentors: 100+

Website [aws.amazon.com/startups](https://aws.amazon.com/startups)

Apple's program supporting underrepresented founders building apps for Apple platforms.

Website: developer.apple.com/entrepreneur-camp

CategoryDetails

Investment Terms Varies by program

Program Length 1 year

Notable Alumni Duolingo, Headspace, Calm

Focus Areas iOS, macOS, watchOS, tvOS

Success Metrics • Companies supported: 100+

• App Store features: 50+

• Success rate: 90%

The American Institute of CPAs' program for accounting and fintech startups.

Website: aicpa.org/accelerator

CategoryDetails

Investment Terms $25K grant

Program Length 6 months

Notable Alumni Botkeeper, Taxfyle, Gusto

Focus Areas Accounting, FinTech, Tax

Success Metrics • Companies accelerated: 50+<br/>• Industry partnerships: 20+<br/>• Success rate: 75%

Website [aicpa.org/accelerator](https://www.aicpa.org/accelerator)

Boeing's venture capital arm and accelerator program for aerospace and advanced manufacturing.

Website: boeing.com/horizonx

CategoryDetails

Investment Terms Varies by program

Program Length 6 months

Notable Alumni Zunum Aero, Cobalt Robotics

Focus Areas Aerospace, Advanced Manufacturing

Success Metrics • Companies invested: 100+<br/>• Strategic partnerships: 25+<br/>• Success rate: 80%

Website [boeing.com/horizonx](https://www.boeing.com/horizonx)

Google's global accelerator program supporting startups across various sectors.

Website: startup.google.com

CategoryDetails

Investment Terms $100K Google Cloud credits

Program Length 3 months

Notable Alumni Duolingo, Headspace, Calm

Focus Areas All sectors

Success Metrics • Companies accelerated: 1000+<br/>• Global locations: 50+<br/>• Success rate: 85%

Website [startup.google.com](https://startup.google.com)

Intel's accelerator program for deep tech startups focusing on hardware and software innovation.

Website: intel.com/ignite

CategoryDetails

Investment Terms Varies by program

Program Length 12 weeks

Notable Alumni Lightmatter, Untether AI

Focus Areas Deep Tech, Hardware, AI

Success Metrics • Companies accelerated: 150+<br/>• Technical mentors: 100+<br/>• Success rate: 80%

Website [intel.com/ignite](https://www.intel.com/ignite)

Demo day is your moment to shine in front of hundreds of potential investors. Here's how successful founders make the most of this opportunity:

Before the Big DayThe weeks leading up to demo day are crucial for preparation. Start by researching the investor audience - understand their portfolios, investment theses, and recent deals. Create multiple versions of your pitch to resonate with different investor profiles. For international accelerators, consider timezone differences when scheduling follow-up meetings. Most importantly, leverage your mentor network to get candid feedback on your pitch and make refinements.

Perfecting Your PresentationWhether virtual or in-person, your presentation needs to be flawless. Invest in professional recording equipment if presenting virtually - poor audio or video quality can kill investor interest instantly. Practice your timing religiously - most accelerators give you just 3-5 minutes to tell your story. Focus on your most compelling metrics and be prepared to address questions about regional expansion plans, especially for international investors.

The real work begins after your presentation. Have your pitch deck ready to share via secure, trackable links the moment investors express interest. Using Papermark's analytics, you can see which investors spend time reviewing your financials or growth metrics, helping you tailor your follow-up conversations. Keep your data room updated with fresh metrics and be ready to share access selectively while maintaining control over sensitive information.

Share your pitch deck securely

Conclusion: Choosing the Right Global Accelerator in 2025The key to selecting the right accelerator lies in understanding your startup's needs and growth trajectory. Consider factors like:

Geographic focus and market access

Industry expertise and mentor network

Investment terms and program structure

Alumni success stories and network

Post-program support and resources

Remember to protect your intellectual property during the application process by using secure pitch deck sharing tools and maintaining control over your sensitive information.

Start sharing your pitch deck